by romzbajalan@gmail.com | Jun 10, 2021 | Uncategorized

Top Small Business Accounting Errors — Idea to expand on? Accounting software has made record keeping easier for small business and at the same time creating new common accounting errors as well. Some may be insignificant and easy to correct while other errors...

by armari22@gmail.com | May 26, 2021 | About Pi

Pi Business Solutions is a bookkeeping company in Calgary that has been serving clients for over 10 years now. They’ve mastered the art of bookkeeping and are ready to share their expertise with you, so you can be successful too! In this blog post, we will...

by armari22@gmail.com | May 26, 2021 | About Pi

As small business accountants in Calgary, Pi Business Solutions is passionate about providing you with the attention and dedication that your small business deserves. With over 20 years of combined experience helping small businesses succeed, our team will ensure that...

by armari22@gmail.com | May 26, 2021 | About Pi

Pi Business Solutions is a tax accounting company in Calgary, Canada. We are dedicated to providing entrepreneurs with the peace of mind they need for their business. It can be exhausting and overwhelming at times, and we understand this. Let us help you get your...

by romzbajalan@gmail.com | Oct 16, 2017 | Businesses, news, Tax

The federal government announced today that they intend to honour their campaign promise of 2015 to lower the small business corporate tax rate to 9% over the next 15 months. This would bring the combined federal and provincial taxes on the first $500,000 of annual...

by romzbajalan@gmail.com | Sep 19, 2017 | Articles, Businesses, news, Tax

The federal government has proposed significant changes to the way that small business corporations will be taxed. Teri sits down with Robin Spiers to discuss Pi’s position on this. View...

by romzbajalan@gmail.com | Mar 24, 2017 | news, Tax, Tips

A single parent income tax return is one of the most reviewed returns by the Canada Revenue Agency. To avoid delays with either your income tax refund and/or your child tax benefits please bring the following information to your appointment. Court order or custody...

by romzbajalan@gmail.com | Feb 7, 2017 | news, Tax

This is a question that we hear on a consistent basis. Most people know if they are single or not, married or not, widowed or divorced but what about the in-between. What are the rules on this topic for tax purposes? What people think and what the Canada Revenue...

by romzbajalan@gmail.com | Jan 3, 2017 | Alberta, Articles, Businesses, news, Tips

We got out our December newsletter with 3 days to spare this month. If you aren’t subscribed (or the email got lost in all of your holiday e-cards), you can go to our Newsletter tab at the top of the page to subscribe and see our previous issue. You can also...

by romzbajalan@gmail.com | Nov 4, 2016 | Businesses, news, Tax, Tips

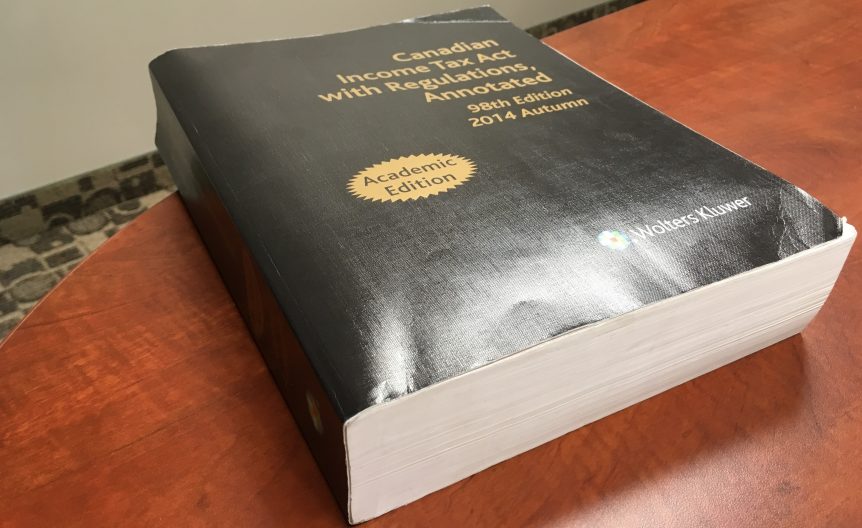

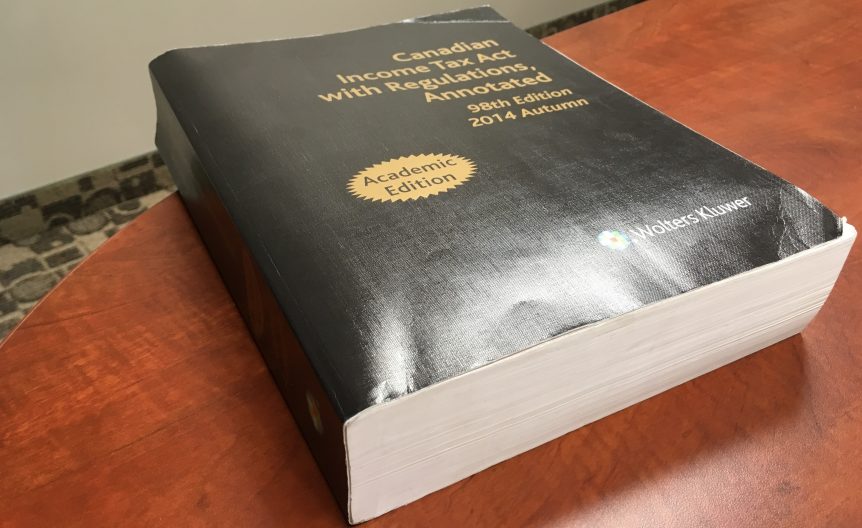

Every year the Income Tax Act gets bigger (currently over 2,700 pages) and the personal T1 Return gets more complicated. The current Liberal government has announced their intention to simplify the Act by eliminating tax credits. Bill Curry from the Globe and Mail...