by romzbajalan@gmail.com | Oct 16, 2017 | Businesses, news, Tax

The federal government announced today that they intend to honour their campaign promise of 2015 to lower the small business corporate tax rate to 9% over the next 15 months. This would bring the combined federal and provincial taxes on the first $500,000 of annual...

by romzbajalan@gmail.com | Sep 19, 2017 | Articles, Businesses, news, Tax

The federal government has proposed significant changes to the way that small business corporations will be taxed. Teri sits down with Robin Spiers to discuss Pi’s position on this. View...

by romzbajalan@gmail.com | Mar 24, 2017 | news, Tax, Tips

A single parent income tax return is one of the most reviewed returns by the Canada Revenue Agency. To avoid delays with either your income tax refund and/or your child tax benefits please bring the following information to your appointment. Court order or custody...

by romzbajalan@gmail.com | Feb 7, 2017 | news, Tax

This is a question that we hear on a consistent basis. Most people know if they are single or not, married or not, widowed or divorced but what about the in-between. What are the rules on this topic for tax purposes? What people think and what the Canada Revenue...

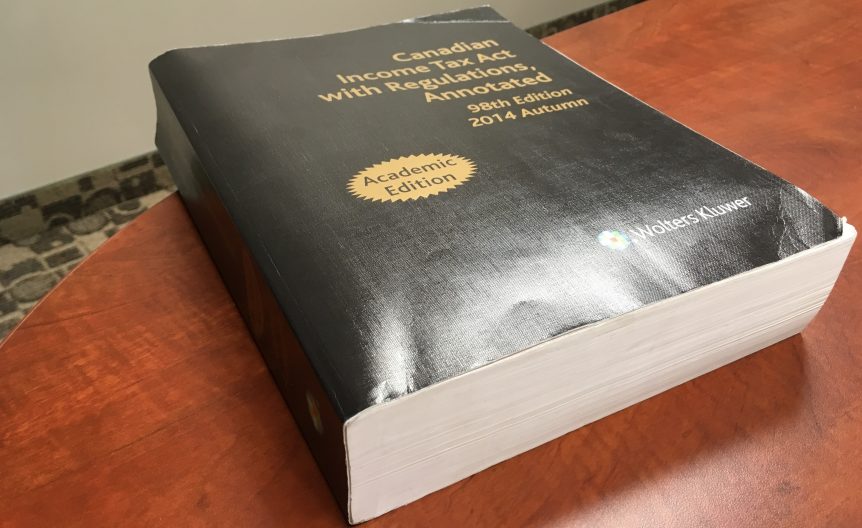

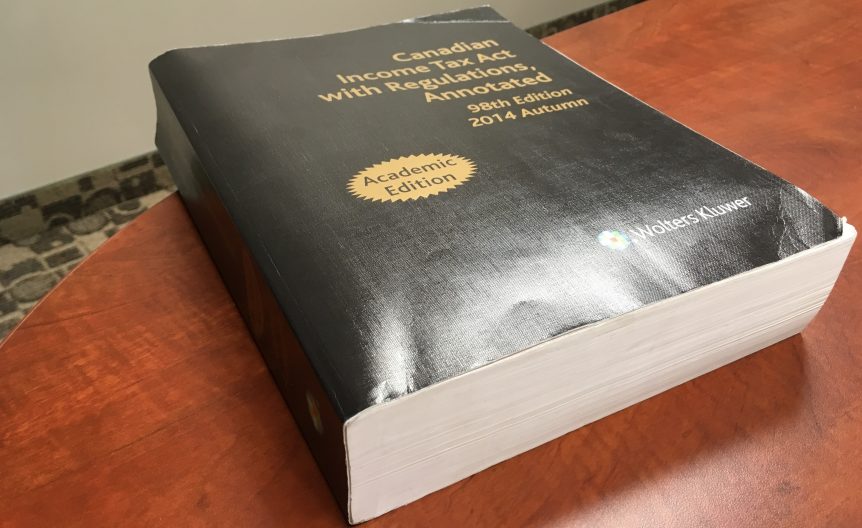

by romzbajalan@gmail.com | Nov 4, 2016 | Businesses, news, Tax, Tips

Every year the Income Tax Act gets bigger (currently over 2,700 pages) and the personal T1 Return gets more complicated. The current Liberal government has announced their intention to simplify the Act by eliminating tax credits. Bill Curry from the Globe and Mail...

by romzbajalan@gmail.com | Oct 28, 2016 | Articles, Businesses, news, Payroll, Tax

In our October newsletter, we showed how the real cost of the minimum wage increases is higher than is commonly discussed and that it is the business owner who shoulders those costs. This leaves a hard decision for the employer. A basic concept of accounting is that...